Short answer: If you want speed, certainty, and less hassle, a cash offer can be the easy button. If you have time to spare and your home is in list ready condition, then a traditional listing may fit. With Offerpad, you can compare both and pick your best way to sell.

What does “selling your home for cash” actually mean?

It means the buyer doesn’t need a mortgage. No lender hoops, no financing drama. If you agree on $350,000, the buyer must show they’ve got $350,000 ready to go. Most cash buyers are investors, home‑buying companies like Offerpad that make the process fast and predictable. Getting a cash offer means skipping straight for the good stuff: speed, simplicity, and certainty. You pick your own closing date and we even throw in a free local move. It’s the stress-free way to sell your home, so you can spend less time worrying about the process and more time getting excited about what’s next. For more information see our cash offer guide with the top 10 reasons homeowners choose the cash offer.

Why sellers choose a cash offer

- Free local move. Sell to Offerpad for cash and get a free local move up to 50 miles. For free? For real!

- Speed—like, really fast. Close in as little as 7 days. Traditional sales can take months with appraisals, approvals, and paperwork.

- No renovations, cleaning, or staging. Sell as‑is. Skip the weekend projects and endless showings. Your pets will thank you.

- Lower out‑of‑pocket costs. Many cash options reduce or cover closing costs. With Offerpad, there are no surprise fees and you see your bottom line upfront.

- Certainty. No financing contingency = less chance the deal falls apart last minute.

- Your timeline. With Offerpad, pick your closing date (7 to 60 days) and stay up to 3 days after closing for a smooth handoff.

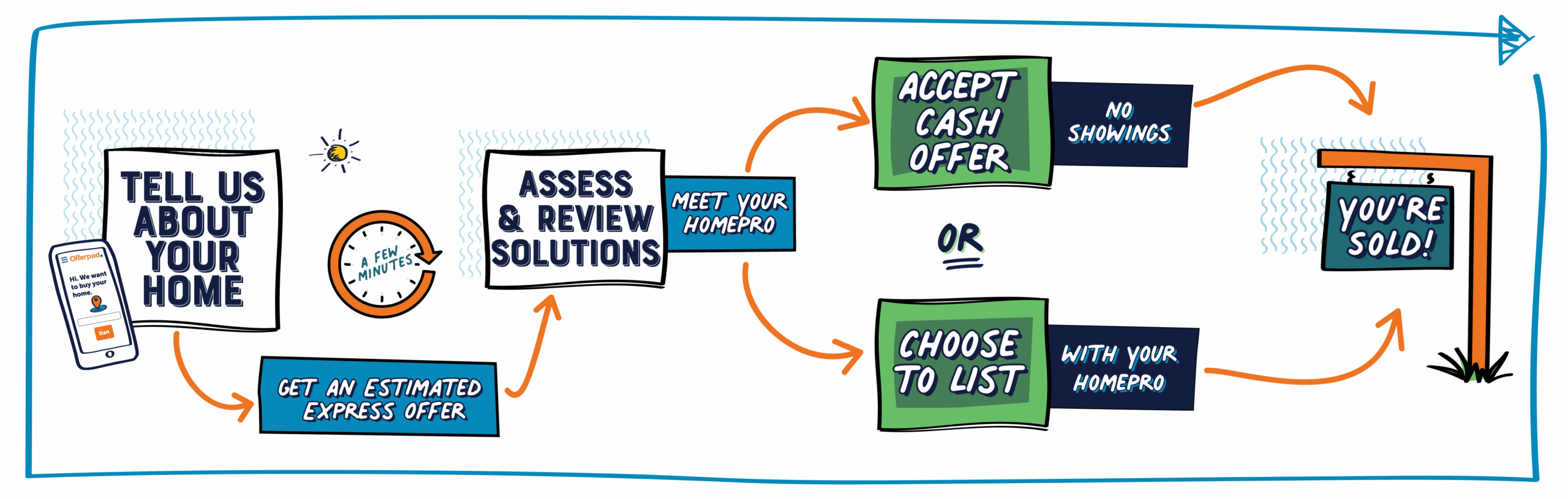

How a cash sale works (simple, step‑by‑step)

- Request an offer. Share your address and a few details online.

- Property review. A quick in-person assessment to confirm condition and value.

- Get your offer. You’ll receive a clear, no‑obligation cash number.

- Choose terms. Pick your closing date and any extras you want help with.

- Close & get paid. Fewer steps, no lender delays, sign and you’re done. Funds are typically wired shortly after closing.

Want the white‑glove version? See how Offerpad works.

Cash sale vs. traditional listing

| Aspect | Cash Sale | Traditional Sale |

|---|---|---|

| Timeline | About 7–30 days (you choose) | Often 60+ days after offers, appraisals, lender approval |

| Renovations & prep | Usually none, sell as‑is | Renos, cleaning, landscaping, staging |

| Showings | None | 10–25+ showings on average |

| Certainty | High, no financing contingency | Deals can fall through due to financing or appraisal |

| Costs | Lower, fewer surprise fees | Agent commission + closing costs |

| Control | Pick your closing date; stay 3 days after closing (Offerpad) | Less flexibility; timing tied to the buyer and lender |

Not sure which path fits? With Offerpad, you can compare your options and choose what’s right for you—cash, listing, or a hybrid approach.

Who actually buys homes for cash?

- House flippers: Buy, renovate, resell. Typically aim for deeper discounts to cover repairs and profit.

- Buy‑and‑hold investors: Keep properties as rentals. Often pay more than flippers but less than iBuyers.

- iBuyers and Offerpad: Use data and local expertise to make competitive offers on homes and leverage economies of scale to bring down renovation costs and improve resell value.

Choosing the right cash home buyer

Offerpad isn’t a buy-and-hold landlord, we’re renovators. When we purchase a home, our team refreshes and renovates it, then puts it right back on the market so buyers can snag a move-in-ready place fast. Unlike many investors who hold properties as long-term rentals (which can shrink inventory and push prices up), we return homes to the market quickly to keep supply moving and stress down for everyone. Freedom. Simplicity. Peace of mind, and more homes available when people need them.

The trade‑off: price vs. convenience

Most investors won’t pay full market value because they budget for repairs, carrying costs, and risk. iBuyers typically pay closer to market value than flippers, and you’ll see all pricing and any service fees upfront. With Offerpad, you’ll know exactly how much you’re walking away with

When the cash route shines: tight timelines, inherited homes, costly renovations, or when you want a sure thing without months on the market.

How to avoid cash‑buyer scams

- Check credibility: Look for established companies with real reviews and a strong track record.

- Ask for proof of funds: Legit buyers can show they have the cash.

- Get it in writing: Beware of vague promises or last‑minute deductions.

- Compare offers: A trusted company like Offerpad lets you see both cash and list options so you can make the best call.

Quick FAQs

How fast can a cash buyer close?

With Offerpad, as fast as 7 days — or later if that works better for your move. (closing times vary by market, see FAQ

Will I make less than listing on the open market?

Often, yes — that’s the trade for speed and certainty. But when you factor in time, renovations, double mortgage payments, and potential price cuts, the gap might be smaller than you think. We’ll help you compare both paths before you decide.

What if I prefer to list?

Easy. We offer flexible listing options, too. You can explore both to choose what fits your goals.

Bottom line

Selling a home doesn’t have to be complicated. If you want quick, simple, and certain, a cash offer is the way. If you want to test the market, we can help there, too. With Offerpad, you’ll always know your options—cash, list, or both—along with clear pricing, flexible timelines, and even a free local move when you sell to us for cash.

Get started and choose your best way to sell.