Looking for a fast, reliable way to sell your home without the delays of traditional listings? You’re not alone. Companies that buy homes for cash are transforming the real estate landscape—making it quicker, simpler, and more convenient. Let’s explore how these services work, why they’re gaining popularity, and how to find the right one for you.

Why Cash-Home Buyers Are Rising

Across the U.S., all-cash purchases are surging. In January 2024, 32% of home sales were cash transactions—the highest since 2014. Many of these buyers were vacation purchasers or investors riding equity from previous home sales. Cash transactions are particularly attractive in competitive housing markets where sellers prefer certainty and quick timelines.

Redfin reported that as of September 2023, 34.1% of U.S. home purchases were made in cash, climbing from 29.5% the year before, with luxury homes leading—46.8% of high-end purchases were cash in early 2024. This growth shows the appeal of bypassing mortgage approvals and appraisals that often delay traditional sales.

Local markets also reflect this surge. In Pittsburgh, cash-buy transactions hit 30.6% in 2024—the highest since 2014. In Miami’s luxury segment, over 53% of homes priced $1M–$5M, and nearly 59% of homes over $10M were bought with cash in early 2025. These figures highlight the fact that cash transactions are no longer niche—they’re mainstream.

How Cash-Home Buyer Companies Work

These companies—also known as iBuyers or we-buy-houses investors—make upfront offers for your property, often “as-is,” cutting out listing agents, open houses, and bank appraisals. Unlike traditional buyers who may need weeks for financing approval, cash-buying companies rely on available funds or investor backing to close quickly.

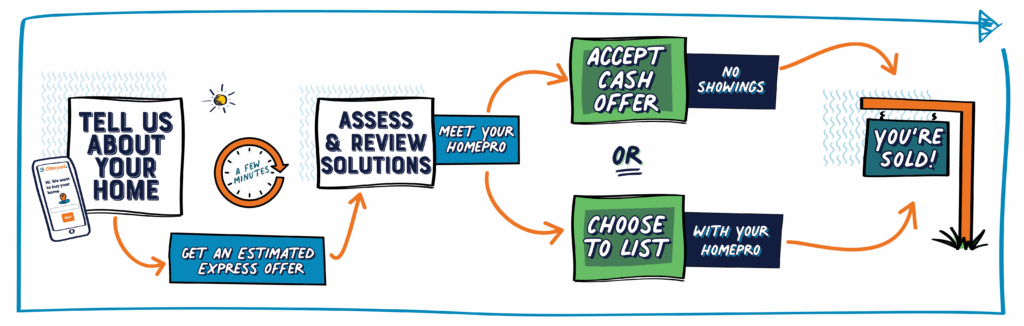

The process usually looks like this: homeowners request an offer online, receive a valuation based on market data, and then either accept, reject, or negotiate the terms. If accepted, the company handles most of the paperwork and can often close within 7–14 days. For sellers who value speed, this certainty is invaluable.

How getting a cash offer works: (using Offerpad as an Example)

Why You Might Consider Them

- Fast closings: No financing delays, appraisals, or staging stress.

- Sell “as-is”: Even homes in disrepair can attract offers.

- Reliable process: Less chance deals fall apart due to mortgage issues.

- Privacy: Avoid open houses and public listings if you value discretion.

- Flexibility: Many buyers allow you to choose your closing date, giving time to move on your own terms.

Key Statistics

- Offerpad operates in over 1,700 cities and towns across the U.S., providing sellers wide access to convenient, cash-offer options. Source: Offerpad

- iBuyers currently account for around 1% of the U.S. residential market, with some local markets seeing penetration as high as 5%—indicating growing regional strength. Source: Housing Notes, Source: Appraisal Buzz

- Search interest in cash buyers has surged 93% in the past five years, reflecting rising consumer awareness and demand for fast, tech-driven home-sale alternatives. Source: Exploding Topics

- Studies show iBuyer entry can raise your home price by up to 2.8%, demonstrating the positive influence of iBuyer competition and increased seller expectations. Source: Springer Journal of Real Estate Finance and Economics

- 32% of U.S. home sales were all-cash in Jan 2024 (highest since 2014). (NAR)

- 34.1% of U.S. purchases in Sept 2023 were cash; luxury home cash buys reached 46.8% in early 2024. (Redfin)

- Miami: 53.5% of $1–5M homes and nearly 59% over $10M were cash deals in 2025. (NY Post)

- Pittsburgh: 30.6% of home purchases were cash deals in 2024. (Axios)

- Nationwide, about 27% of real estate transactions are cash-based; WV leads with 41.1%. (HouseCashin)

- Investor purchases grew to 27% of all home sales in Q1 2025. (AP News)

- In Florida alone, nearly half of all luxury home transactions were all-cash in 2024. (Redfin)

- Cash sales cut closing timelines by an average of 22 days compared to mortgage-backed sales. (Zillow Research)

Notable Cash-Home Buyer Companies, Ranked by Highest BBB Rating:

- Offerpad — Rating: A+, Pros: Competes on offer price, free local move, flexible close dates. Cons: deductions in cases where major repairs are needed.

- We Buy Ugly Houses — A+ rating. Average offers, ideal for distressed properties. Pros: take nearly any property. Cons: typically lower offers, less tech-driven process.

- Opendoor — Competitive offers, great for homes in good condition. BBB A- rating. Pros: quick offers, flexible move-outs. Cons: service fees, strict condition requirements.

- Homeward — BBB A- rating. Offers upfront cash, then lists for higher potential. Pros: innovative model. Cons: not available in all markets.

- EZ Home Sale (Mesa, AZ) — BBB A-. Accepts homes “as-is” locally. Pros: local expertise. Cons: smaller coverage area.

Risks & Red Flags to Watch For

Not every cash buyer operates with transparency. Here are some red flags sellers should look out for:

- Unlicensed buyers: Always verify credentials and BBB accreditation.

- Unclear fees: Watch for hidden costs deducted at closing.

- Incorrect offer comps: Some buyers may use lower AVMs to undervalue offers.

- No written contracts: Always insist on documented agreements reviewed by an attorney if possible.

Tips for Maximizing Your Offer

- Request multiple quotes: Don’t settle for the first offer you receive.

- Understand your local market: If demand is high, leverage that for stronger negotiations.

- Highlight improvements: Even minor upgrades (fresh paint, cleaning) can make a difference in the valuation.

- Ask about flexible options: Some companies allow you to list traditionally while holding a cash backup offer.

- Review terms carefully: Understand service fees, repair costs, and closing timelines before accepting.

How To: Sell Your Home for Cash

-

Research reputable cash-home buyer companies.

Look for BBB ratings, online reviews, and transparent fee structures.

-

Request and compare offers.

Gather multiple quotes to understand cash offer ranges.

-

Review terms thoroughly.

Check for service fees, repair deductions, and closing flexibility.

-

Accept the best offer and close quickly.

Finalize paperwork, skip repairs if desired, and close—often within days.

Glossary

- iBuyer

- A technology-driven company that makes quick, all-cash offers on homes, usually as-is.

- As-Is Sale

- Selling a property without making repairs or improvements; buyer accepts the condition.

- Cash Offer

- A proposal to buy a property without financing, using the buyer’s own funds.

- Service Fee

- A percentage charged by the buyer company for facilitating the transaction (often ~8%).

- Backup Offer

- A conditional offer allowing the seller to pursue a traditional sale while holding a cash offer as fallback.

- Equity

- The portion of the home’s value that the owner truly owns, after subtracting any mortgages or loans.

- Escrow

- A third-party account where funds are held until all terms of the sale are met.

Quotes & Real-Life Stories

“These housing consumers owned a home, sold it and then they could purchase their next property without a mortgage.” — NAR Deputy Chief Economist Jessica Lautz

“In a market where sellers are accustomed to cash, a financed buyer can appear less attractive.” — Ana Bozovic, Analytics Miami

Owner story #1: A homeowner in Pittsburgh sold to a cash buyer, closing in days, skipping repairs and open houses—perfect for their job relocation. This allowed them to settle into a new city quickly without carrying two mortgages.

Owner story #2: A Miami homeowner accepted a cash offer above $10 M, closing swiftly without typical financing hassles. For them, speed was everything as they were downsizing after retirement and wanted liquidity for investments.

Owner story #3: In Arizona, a family facing foreclosure avoided financial distress by working with a reputable cash buyer. The ability to sell quickly not only relieved debt pressure but also preserved their credit score.

Thinking Bigger? Choose Offerpad for Speed, Convenience & Confidence

When selling your home for cash, Offerpad brings speed, tech-powered ease, and peace of mind to the table. Here’s why:

- Fast, flexible closings—with home sellers often wrapping up in days, not weeks.

- Option to sell “as-is” or list traditionally—with a cash backup in place.

- Local move assistance for smoother transitions.

- High customer satisfaction—91% satisfaction rating and 67 NPS in 2023.

- BBB A+ rating and track record with quick, transparent offers.

“The ease of selling my home with Offerpad was a game-changer—I avoided repairs, closed in just days, and felt supported every step of the way.” — Inspired by many homeowner reviews

Ready to skip the stress and get ahead with a fast cash offer? Offerpad is here with certainty, flexibility, and real value. Start today and experience the difference.

Companies That Buy Homes – FAQs

What does “company that buys homes” mean?

These are professional homebuyers that purchase houses directly from sellers—often for cash—so you can skip listings, showings, and months of uncertainty.

How does the process work?

Share a few details about your home, get an offer (often in minutes), complete a quick evaluation/inspection, and choose your closing date. It’s designed to be fast, simple, and predictable.

How fast can I close?

Many direct homebuyers can close in as little as 7–14 days, or later if you need flexibility. Your timeline, your call.

Do I need to make repairs or clean?

Usually, no. Most companies buy homes “as is,” which means you can skip weekend projects and deep cleaning. Any repair-related costs are typically handled through pricing or post-inspection adjustments.

Will the offer be competitive?

Direct buyers aim to make market-informed, data-driven offers. While you’re trading some upside for speed and certainty, many sellers find the time savings, fewer hassles, and reduced risk well worth it.

What fees should I expect?

Fees vary by company and local regulations. Some charge a service or convenience fee; others do not. Always ask for an itemized breakdown of fees, expected closing costs, and any repair credits so you can compare your net proceeds.

How do companies determine my home’s price?

They combine recent local sales, current market trends, your home’s condition, and unique features. Many use expert valuation teams and technology to keep offers consistent and fair.

Can I back out before closing?

Policies differ by company. Many allow you to cancel before certain deadlines with little or no penalty. Read the contract for timelines, inspection periods, and any cancellation fees.

Can I sell my house if I still have a mortgage?

Yes. Your mortgage is paid off at closing from the sale proceeds. Any remaining equity goes to you.

Will there be showings or open houses?

Typically no. A direct sale usually requires only a quick evaluation or inspection—far fewer interruptions than traditional listing.

What types of homes do these companies buy?

Most focus on single-family homes, townhomes, and condos within their service areas. Eligibility depends on location, price range, and condition. Ask for their purchase criteria in your ZIP code.

How do I compare a cash offer to listing on the market?

Compare net proceeds and your priorities. Factor in repairs, holding costs, agent commissions (if any), potential price reductions, and the value of speed and certainty. Choose the path that best fits your timeline and stress level.

Are there any perks to look for?

Some buyers offer flexible closing dates, post-closing possession (extra days to move), or even help with local moving. Ask what’s included so you can capture the full value—not just the headline price.

How do I avoid scams?

Work with established, well-reviewed companies. Verify licensing where applicable, read the purchase agreement carefully, request itemized fees, and make sure earnest money and closing funds are handled by a reputable escrow or title company.